Neon price drop likely just from Databricks AWS discounts

Neon lowered compute pricing by 15-25% after it was acquired by Databricks. AWS discounts are likely the reason.

Neon just became the most recent database company to announce a slash in its compute prices, by 15–25%. This news came a few months after they were acquired for an estimated $1 billion by Databricks. Reading between the lines, we can infer that the drop in pricing is a result of merging into Databricks’ AWS account and reaping the rewards of their massive compute discount.

Recap of Neon and Databricks and Neon Pricing Change

Neon is a fully managed Postgres database service that is popular for its separation of compute and storage and its ability to scale to zero (a commonly agreed-upon criterion for being truly considered serverless). It was acquired by Databricks in May 2025, and since then, the company has rolled Neon’s technology into its own product portfolio as Lakebase Database.

Neon has two paid public pricing plans: The Launch Tier with up to 16 vCPU and 64 GB RAM, and the Scale Tier with up to 56 vCPU and 224 GB RAM.

Before the change, Neon’s compute pricing was $0.14 per compute unit-hour on the Launch Tier and $0.26 per compute unit-hour on the Scale Tier. Now, pricing is $0.106 per compute unit-hour on the Launch Tier and $0.222 per compute unit-hour on the Scale Tier, representing the 15–25% drop in compute Neon announced.

How Neon was Able to Lower Compute Charges

Neon stated that the change comes with no degradation in performance or margins; rather, the cost savings were realized through engineering improvements and a shift to Databricks’ infrastructure:

Second, since joining Databricks, Neon runs on one of the world’s largest and most efficient multi-cloud infrastructures. Databricks launches tens of millions of VMs daily, and that scale translates directly into lower costs for Neon users.

"Databricks infrastructure," of course, means AWS, Azure, and GCP infrastructure.

So, reading between the lines: unless Neon uncovered a major architectural optimization, the lower prices likely stem from a massive step up in their negotiated cloud discount after consolidating into Databricks’ AWS account.

At Vantage, we see this dynamic play out across thousands of customers spending anywhere from $50 million to $500 million annually on hyperscalers. There’s a broad spectrum of possible discounts, depending on commitment size and usage mix.

A refresher on AWS Discounts

On the low-end, AWS Savings Plans are the "self-serve" means of getting up to a 66% discount off the on-demand price in exchange for committing (and paying upfront) for up to three years of spend.

However, if you’re a large organization spending at scale, the bigger lever is negotiating a dedicated enterprise commitment. Under AWS’s Enterprise Discount Program (EDP) or Private Pricing Agreement (PPA) route, you can commit to a multi-year spend level (typically in the millions of dollars per year) and, in return, secure a custom discount across your whole bill (compute, storage, database, network).

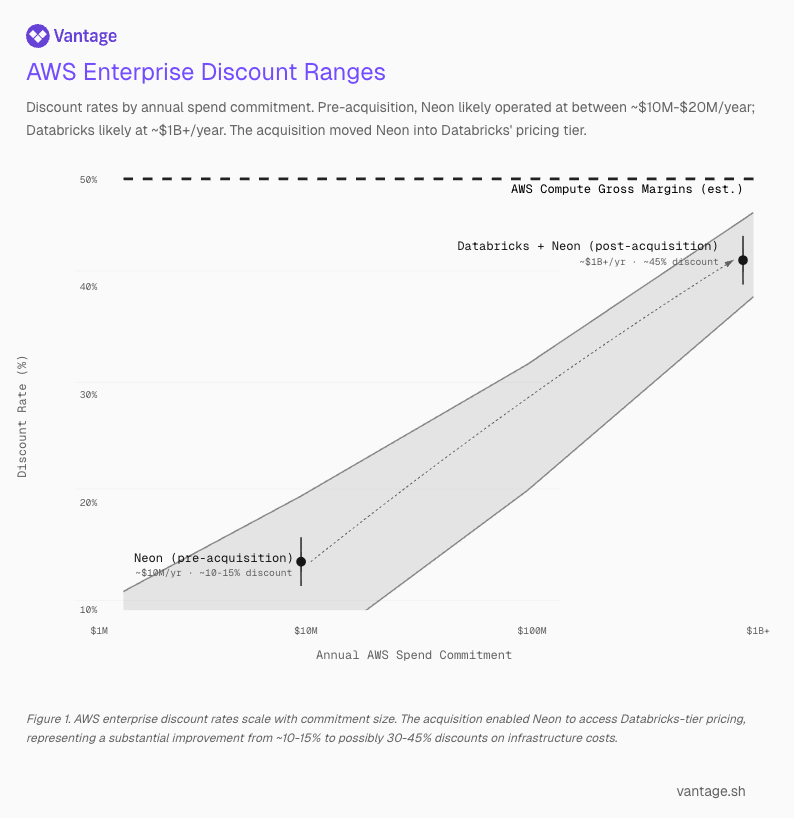

We don’t disclose customer information on EDP or PPA rates, and AWS does not publish "list" discount brackets for EDPs. Industry discussion suggests discounts of perhaps ~5-10% at lower multi‐million-dollar commitments, rising into ~20-30% (or more) for very large commitments.

AWS Discounts for Neon and Databricks

You can think of pre-acquisition Neon and Databricks as living on opposite ends of the discount spectrum. Neon probably spent in the low millions on AWS; Databricks, in contrast, spends in the billions.

AWS discounts are likely substantial on the Databricks side of the scale. Based on aggregate cost and usage data from the Vantage platform, Databricks not only spends billions directly on AWS, but also drives billions more in customer workloads, most of which flow through customers’ own AWS accounts for storage and compute.

Analysts put AWS's gross margins on compute at around 50%, so the upper bound of possible enterprise discounts is roughly that figure. It’s safe to assume Databricks is near the top of that range, likely approaching a 40–50% discount on core compute.

Potential Impact

These types of price changes are uncommon but not unheard of, even though database companies frequently acquire other database companies. Another recent acquisition was the June 2025 Snowflake acquisition of Crunchy Data (another Postgres provider). It will be interesting to see if they follow the same playbook. Snowflake undoubtedly also gets a good rate from AWS, considering much of their $4.5B annual revenue goes towards AWS infrastructure. So far, no pricing changes have been announced.

Another consideration is whether this will put downward pricing pressure on AWS databases. Neon is tiny compared to RDS, so likely no. But if Databricks continues to expand into OLTP for enterprises, where RDS is by far the biggest, it's possible that this could create some pricing pressure on RDS. AWS hasn’t meaningfully reduced database pricing in years; the last notable "cut" was in 2023 when Amazon introduced a new pricing model for Aurora I/O costs. Historically, AWS made regular price reductions, but that trend has slowed.

Conclusion

Neon’s 15–25% price cut isn’t just an act of generosity; it’s a reflection of what happens when a smaller startup joins a buyer with hyperscaler-scale leverage. Databricks’ immense purchasing power has effectively trickled down to Neon’s users. Whether it becomes more common for companies to decrease prices after mergers remains to be seen.

Sign up for a free trial.

Get started with tracking your cloud costs.