Cloud Cost Report

The Q3 2022 Cloud Cost Report analyzes real-world data to quantify how cloud spending patterns are changing.

Cost optimization is a top priority for organizations in 2023, and cloud spend is one of the best opportunities for reducing costs. Vantage is a cloud cost management and optimization platform with a unique dataset of thousands of AWS accounts and how they are allocating resources. This Q3 Cloud Cost Report uses anonymized, real-world data to quantify how cloud spending is shifting and changing. To discuss this report in more detail, join our growing Slack Community of over 1,000 FinOps and cloud professionals. This report analyzes interesting trends to provide engineering leaders, FinOps professionals, and CFOs with emerging and evolving patterns.

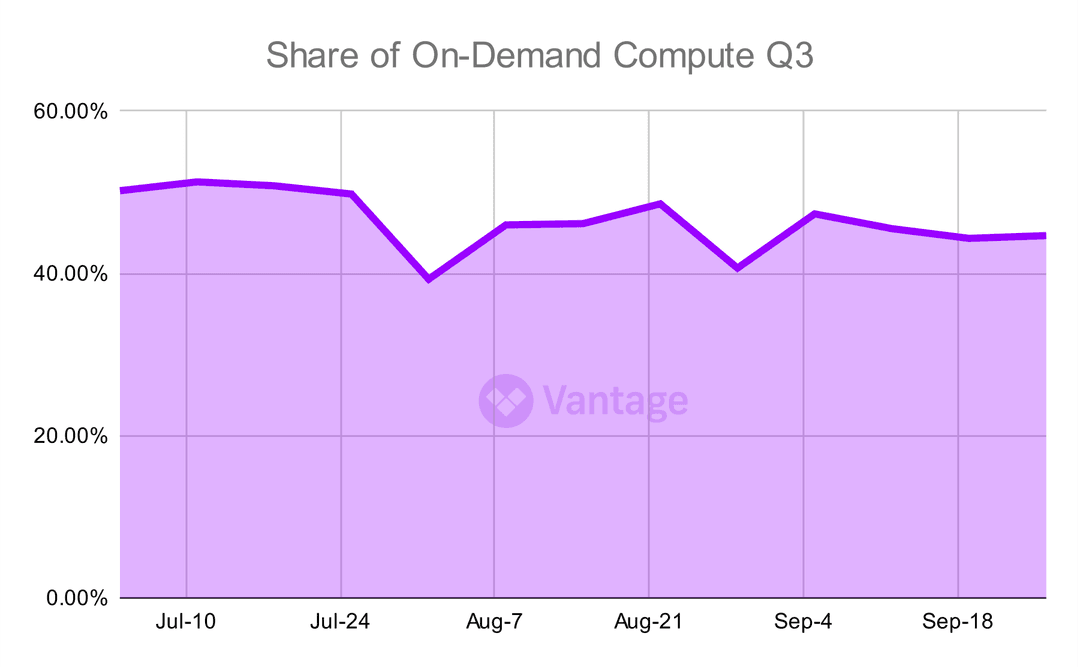

Committed spend is on the rise as bottom lines come into focus

On-demand compute costs are decreasing as a percentage of total compute spend, despite still being at relatively high levels in aggregate. On-demand compute as a share of costs has decreased from 50.19% a year ago to 44.66% at the end of Q3.

As bottom lines have come more into focus as financial markets correct we've seen more customers opt to make commitments in the form of AWS Savings Plans and Reserved Instances.

We expect this trend to continue as compute spend remain the major area of optimization for most organizations.

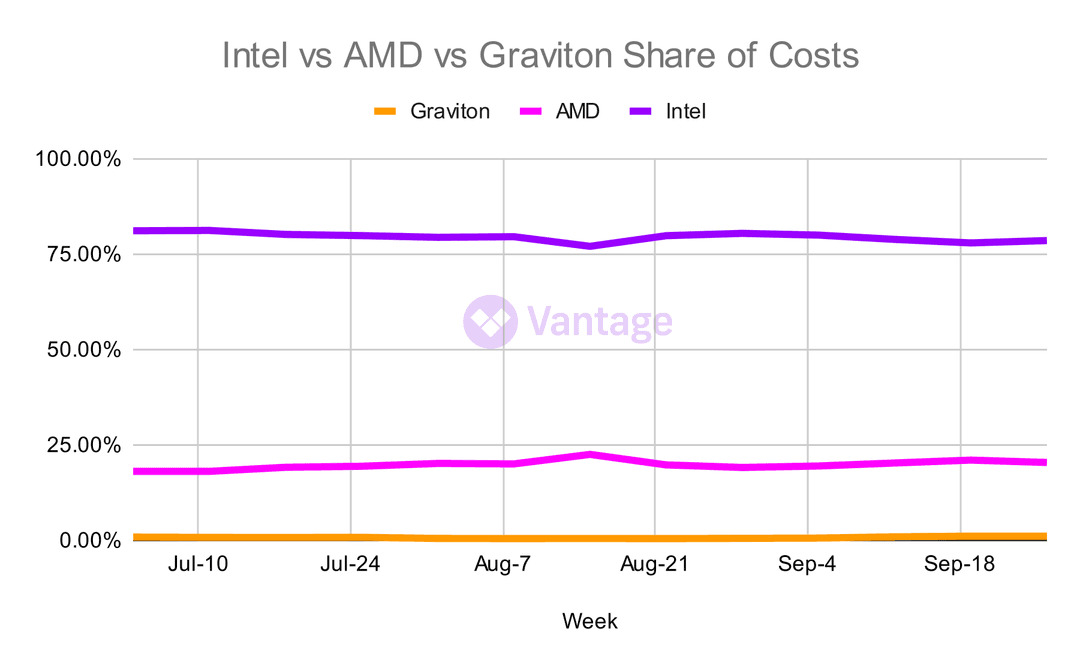

Intel Still Dominates

Intel remains dominant among traditional servers even with the much-hyped rollout of ARM Graviton processors on AWS. AMD holds onto 20% of the compute market share.

While we see more forward thinking organizations make shifts over to AWS Graviton, its adoption is still low in comparison at less than 1% of represents EC2 costs.

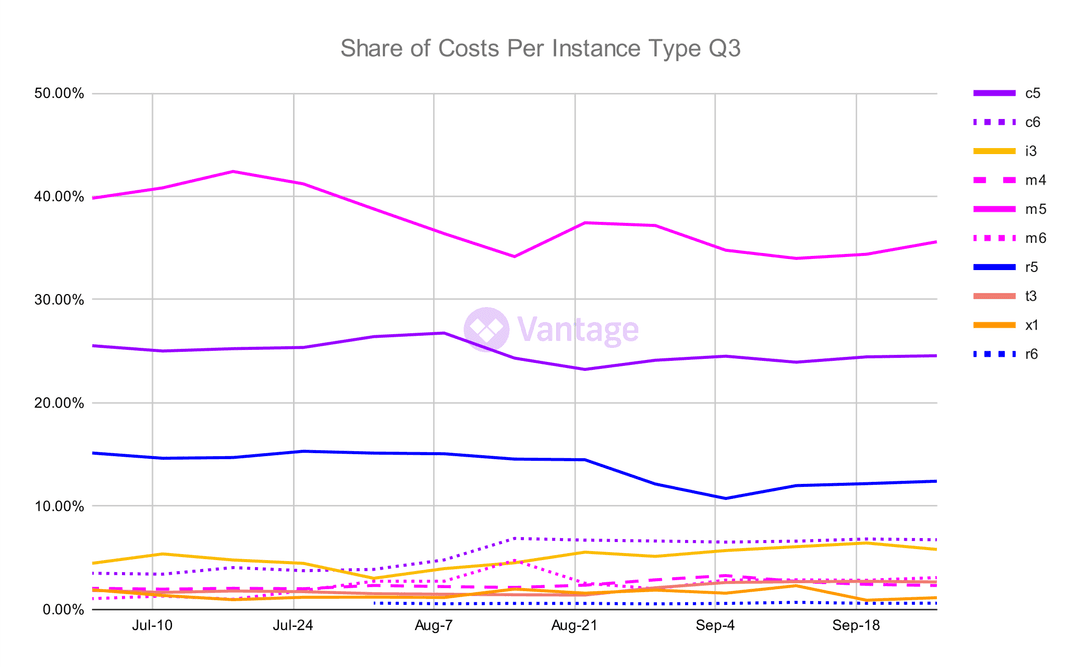

Companies are Slow to Upgrade to Newer Instances

Although newer generation instances have often been available for a while, companies are slow to move to them. In our data the c5, m5, and r5 instances make up the vast majority of compute costs, with c6, m6, and r6 instances only beginning to make a dent this past quarter.

In contrast with serverless workloads, EC2 instance upgrades are not happening as quickly even though newer generations offer better performance and lower costs than previous generation instances.

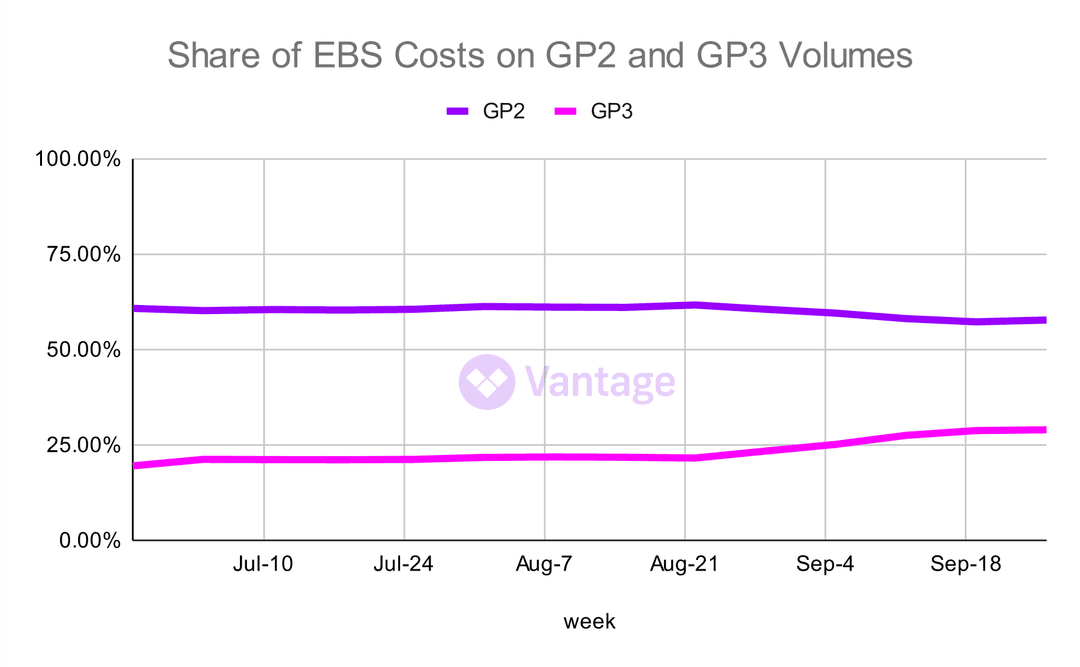

GP2 vs GP3: Older Storage Volumes are Driving Higher Costs

Newer and more cost effective GP3 volumes have been available since 2020 but the majority of block storage costs are still on older GP2 volumes as presumably most customers don't fully grasp price-to-performance implications.

Despite the fact that customers can save 20% on block storage and achieve higher I/O performance for their volumes by upgrading, many customers are slow to transition.

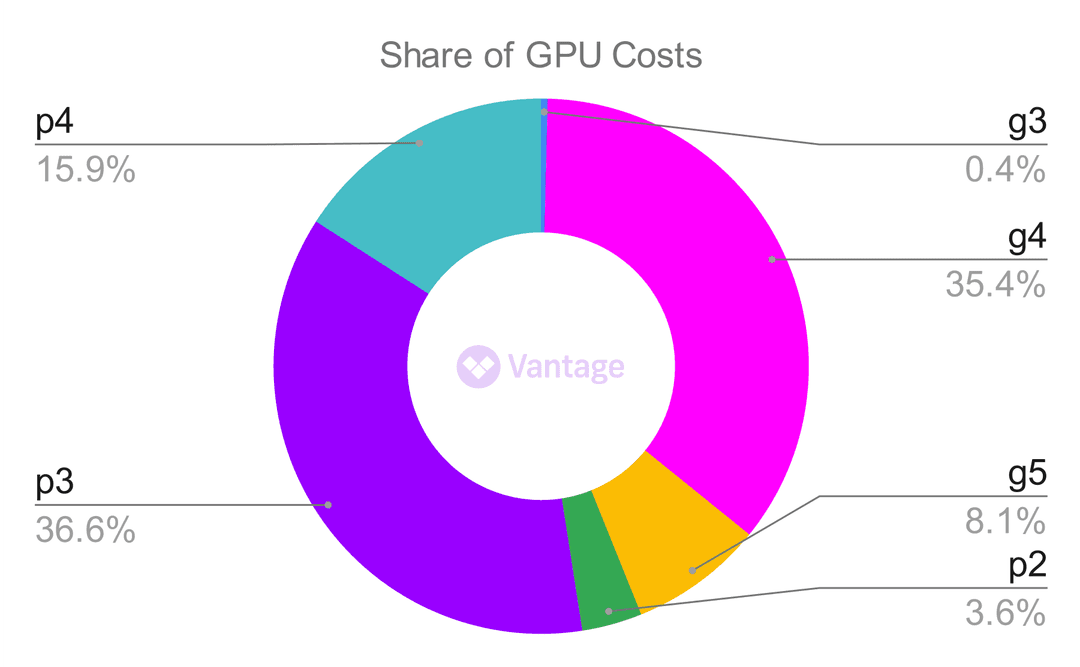

The Share of GPU Spend In the Era of AI

There are many GPU types available in the cloud. While AI training and inference are leading use-cases, a large share of spend is devoted to g4 instances which are best for graphics workloads. For example, virtual workstations (or 'cloud desktops') help organizations adapt to remote-work quickly and in some cases provide repeatable development environments for developers.

Today's large models need p3 or p4 machines which contain NVIDIA's latest server-class boards and provide the amount of video memory and tensor cores needed to train large language models like GPT3 or generative image networks like Stable Diffusion.

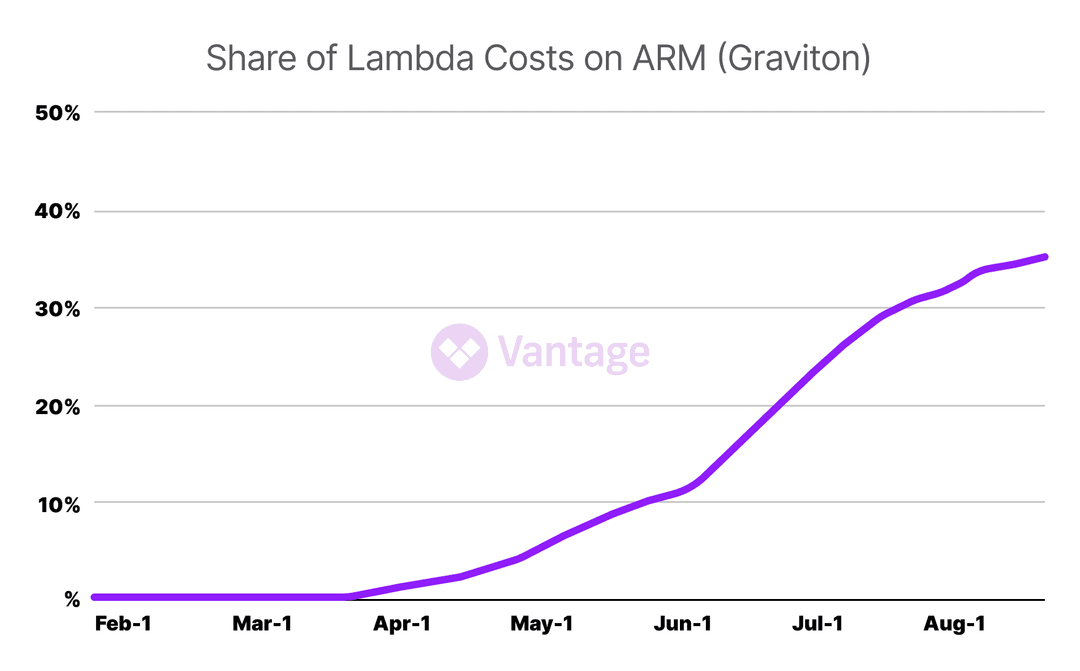

Graviton Adoption on Lambda is Growing Quickly

For serverless workloads on AWS, the CPU picture is much different than EC2. Since these applications are as highly abstracted from the hardware as possible, switching to the best price-to-performance CPU is easier. Here we find that the share of Lambda costs on Graviton are on track to exceed the share of costs on x86 among Vantage users.

The belief here is that adopters of AWS Lambda tend to be more forward-thinking and modern organizations and are cognizant of the price-to-performance benefits that Graviton offers.

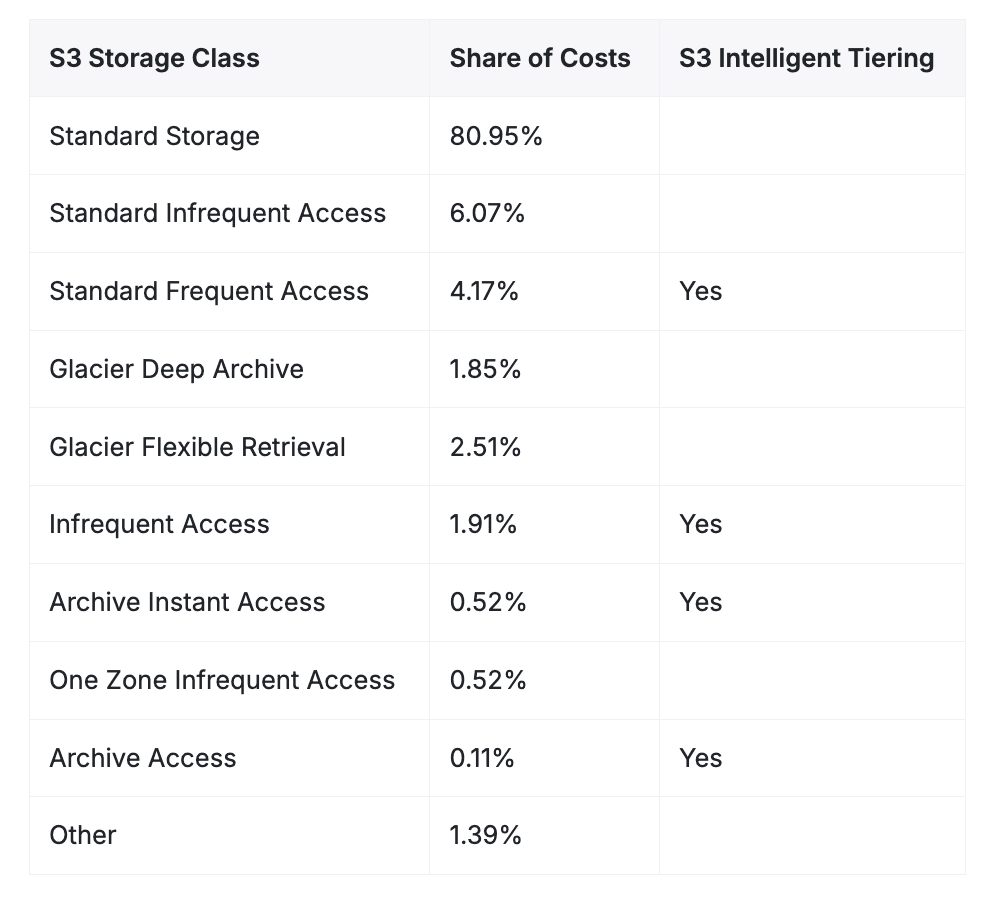

More teams should use S3 Storage Tiers

The vast majority of S3 storage costs were accrued on the standard storage tier - which is the default tier for S3. AWS offers services like S3 Intelligent Tiering, which automatically moves objects to cheaper storage tiers based on access patterns has been available since 2018.

There is an added monitoring cost with Intelligent Tiering but this was de-minimis as a sum-total of S3 costs. At this time, Standard Storage accounts for 80.95% of costs, with only about 7% of costs coming from Intelligent Tiering managed tiers (Standard Frequent Access, Infrequent Access, Archive Instant Access, and Archive Access combined).